In accordance with the provisions of the European public procurement directives, every two years the European Commission reviews and updates the so-called EU thresholds (expressed in EUR), which determine the appropriate public procurement procedures and the value of the thresholds expressed in the currencies of those EU Member States outside of the Eurozone.

Based on a communication from the Commission, the President of the Public Procurement Office publishes an announcement in Monitor Polski, setting out the value of the current thresholds and the PLN/EUR exchange rate used to convert the value of public contracts or competitive bids. The new values are binding from 1 January 2024.

New EU thresholds and updated PLN exchange rate

In its latest announcement dated 6 December 2023, the President of the Public Procurement Office provided for an increase in the average PLN/EUR exchange rate to 4.6371 (the previous rate – effective from 1 January 2022 – was 4.4536).

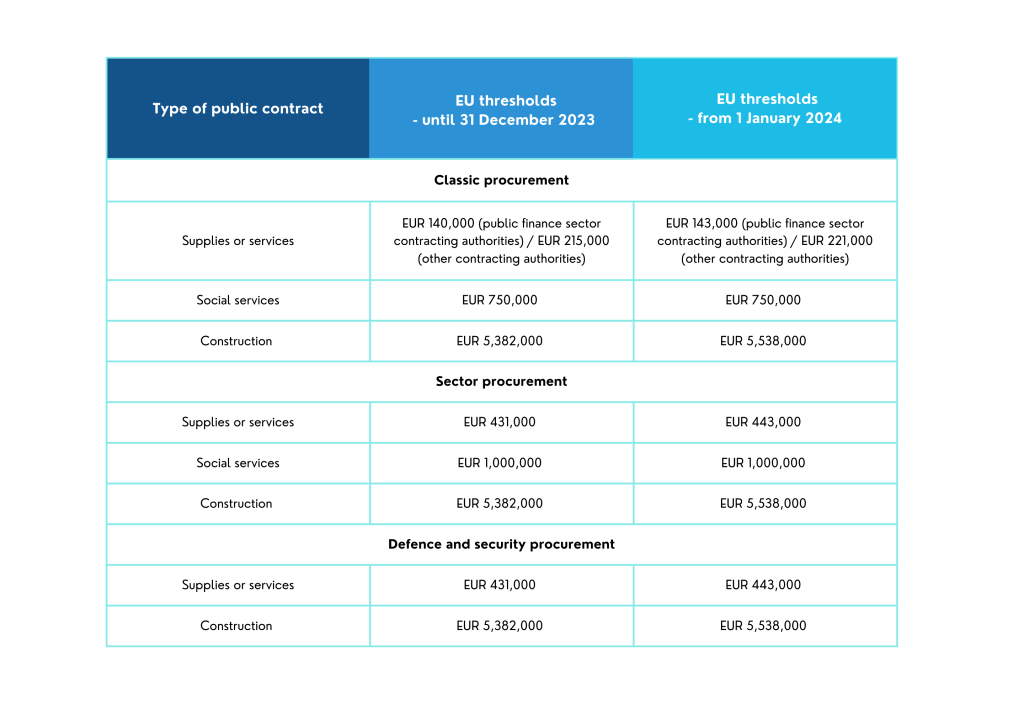

The announcement also included revised EU thresholds.

Comparison of revised and previous thresholds (applicable between 1 January 2022 and 31 December 2023)

The EU thresholds have increased in the majority of cases, as shown in the table above.

How can we help with public procurement

- Assisting in the preparation of public procurement procedures – terms of reference, public contracts

- Analysing bids submitted in public procurement procedures

- Representing contracting authorities before the National Appeals Chamber

Any questions? Contact us