The year 2024 will be marked by increased corporate preparation for sustainability reporting. In addition to the much-discussed requirements of the Corporate Sustainability Reporting Directive (CSRD) and the related European Sustainability Reporting Standards (ESRS), the obligations under EU Regulation 2020/852 on the establishment of a framework to facilitate sustainable investment (Taxonomy Regulation) should not be forgotten.

Taxonomy Regulation – what obligations and challenges await businesses

The Regulation was developed as part of the European Green Deal to direct business activities and investments towards greater environmental sustainability, in line with the EU’s 2030 climate and energy targets.

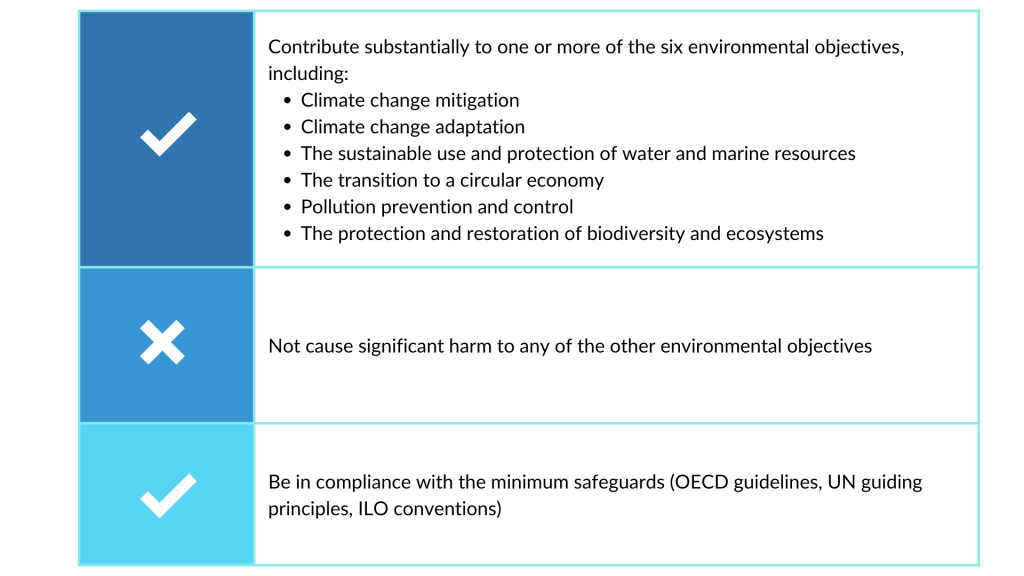

According to the Taxonomy Regulation, for an activity to qualify as environmentally sustainable, it must:

Detailed assessments of whether an activity contributes to or harms environmental objectives are made in accordance with technical screening criteria set out in Delegated Acts that have been developed and implemented in recent years.

In 2022, a delegated act covering the first two environmental objectives, i.e. climate change mitigation and adaptation, entered into force.

And since 1 January 2024, acts have been in force to establish additional technical screening criteria for the remaining four environmental objectives (Regulation 2023/2486) and to extend the list of activities covered by the taxonomy (Regulation 2023/2485).

Who is covered by the EU Taxonomy

The entities required to report are:

- Large undertakings which are public interest entities such as listed companies, banks, insurance companies, or parent undertakings of a large group with more than 500 employees, and are subject to the obligation to disclose non-financial data in accordance with the requirements of Directive 2014/95/EU (NFRD, which was transposed into Polish law in 2017 as part of the amendment to the Accounting Act)

- Entities in the financial sector that offer investment products described as sustainable

- From financial year 2024, companies obliged to provide sustainability information in accordance with the updated CSRD

Under the CSRD, some companies (and more in subsequent years) will have to start reporting as early as 2025, depending on their size and on whether they meet certain criteria. And this is not just about taxonomic issues, but also about more detailed sustainability information, including climate aspects and topics that have not been required so far, such as:

- Presenting the organisation’s plans of transformation and transition towards a low-carbon future,

- Presenting due diligence mechanisms on the organisation’s environmental impacts,

- Reporting on double materiality – the impact of climate change and physical risks on the organisation’s financial performance and situation

- Reporting on the organisation’s impact on the environment

This means that the necessary solutions should be prepared and developed immediately.

At the same time, the range of reportable activities has expanded with the adoption of new delegated acts. The EU Taxonomy Regulation and delegated acts in the area of environmental objectives cover dozens of business activities or types of investment that have the greatest impact on climate change, including in the energy, manufacturing, forestry and transport sectors. In addition, taxonomy reporting includes an obligation to indicate the percentage of revenue, capital expenditure (CAPEX) and operating expenditure (OPEX) related to environmentally sustainable products and services.

In practice, CSRD obligations will also include taxonomy reporting. The two pillars of corporate ‘greening’ – Taxonomy and ESG reporting – will thus meet in one place. Taxonomy reports, prepared on the basis of delegated acts, will become part of CSRD reporting and their scope will be extended to other groups progressively covered by the Directive.

In addition, financial institutions are required to report the share of their investment portfolios that are Taxonomy-eligible and Taxonomy-aligned. These portfolios include both companies that are required to make taxonomy reports and those that are not. Financial institutions can therefore ask non-reporting companies about their Taxonomy eligibility and alignment, irrespective of the requirement to publicly report this information. Voluntary reporting can give a company a competitive advantage with investors.

Benefits of reporting

The expanding range of Taxonomy-reported activities and market expectations make it necessary to adapt to regulatory requirements, and to do so well in advance.

The effect of taxonomy reporting is that the business environment (customers, suppliers, investors) has access to structured data presented by the company according to standardised criteria, identifying sustainable activities. Taxonomy reporting shows not only what sustainable activities a company is currently engaged in, but also how it plans to increase sustainability in the future.

With this in mind, companies should already be taking the necessary steps to align or improve their processes in line with the reporting requirements associated with the EU Taxonomy.

Questions? Contact us